Are ocean freight rates rising across the board in 2025?

- Share

- Issue Time

- Jan 14,2025

Summary

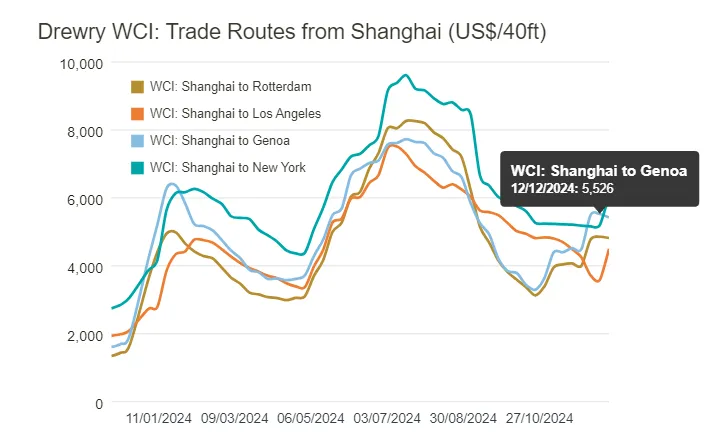

Recently, several world-renowned shipping companies announced that they will raise ocean freight rates across the board starting January 1, 2025.

Recently, several world-renowned shipping companies announced that they will raise ocean freight rates across the board starting January 1, 2025.

Shipping giants such as MSC, COSCO SHIPPING, Yang Ming Marine Transport, Maersk, CMA CGM and HMM have all issued notices of price increases.

MSC's freight rate for each 40-foot container on the US West Coast will increase to US$6,150, and the US East Coast will increase to US$7,150.

COSCO SHIPPING has also raised the freight rate for the US West Coast to US$6,000 and the US East Coast to US$7,000.

Yang Ming Marine Transport plans to raise the General Rate Surcharge (GRI), with the increase for each 40-foot container on the US West Coast and US East Coast being approximately US$2,000.

However, freight forwarding industry insiders pointed out that although many shipping companies have stated that they plan to raise prices starting January 1, they are not in a hurry to make public statements.

Starting from February next year, the three major shipping alliances will be reorganized, and market competition will intensify. Shipping companies have begun to actively grab goods and customers to cope with possible market changes.

Shipping companies and freight forwarding industry insiders said that the final price increase and whether it can be successful will depend on the market supply and demand relationship.

Reasons for the increase in shipping prices!

The reasons for the increase in shipping costs are complex and diverse, involving changes in market supply and demand, rising costs, external environmental impacts and industry competition strategies.

Changes in market supply and demand are an important factor leading to rising shipping costs. As the global economy gradually recovers, trade activities have increased significantly, and transportation demand has risen accordingly. Especially as the Lunar New Year approaches, factories are eager to complete orders and ship before the New Year, which has driven a surge in demand for container shipping.

Rising costs are also a key factor driving the increase in shipping costs. The Panama Canal Authority implemented a new "Long-Term Time Allocation" (LoTSA) system, which has led to a significant increase in operating costs for shipping companies such as CMA CGM. In order to recover the extra costs, shipping companies chose to levy surcharges. In addition, affected by the Israeli-Palestinian conflict, some ships chose to sail around the Cape of Good Hope, which increased the distance, duration, fuel consumption and operating costs. These factors together pushed up the cost of shipping, which in turn prompted shipping companies to raise freight rates.

The uncertainty of the external environment also had an impact on shipping costs. The risk of strikes at ports on the East Coast of the United States still exists. In order to avoid the impact of strikes on shipments, companies accelerated shipments in advance, further driving up freight rates. At the same time, uncertain factors such as emerging tariff policies and strict export restrictions that may appear in 2025 also prompted companies to prepare for shipments in advance, increasing transportation demand.

Industry competition strategy is also one of the reasons for the increase in shipping costs. Although the three major shipping alliances will be reorganized from February 2025 and market competition will be more intense, in January, shipping companies still hope to obtain higher profits through price increases. Some shipping companies have begun to actively compete for cargo sources and customers to cope with future competition. Through technical adjustments to space and reducing supply, shipping companies have effectively controlled market liquidity and, with the help of the atmosphere of price increases, guided customers to expect that freight rates will continue to rise.

Hot sale recommendation

Toyota RAV4 4WD Fashion 2020 Mileage within 60,000 kilometers, in stock, limited stock!

Leiling is made of American version of Toyota A-class car,1.2T+CVT power combination, maximum power 85kW, peak torque 185N · m

Second-hand Changan CS75 car wholesale China export in 2021, mileage within 50,000 kilometers, limited inventory!

The Blue Whale Land Rover has a 2.0T Blue Whale gasoline engine, 233 horsepower, and 390 Nm.