Analysis of China's automobile export overseas markets from January to June 2024

- Share

- Issue Time

- Jul 26,2024

Summary

Looking ahead to 2024, China's annual automobile exports are expected to hit a new high. With the accumulation of scale and technological advantages…

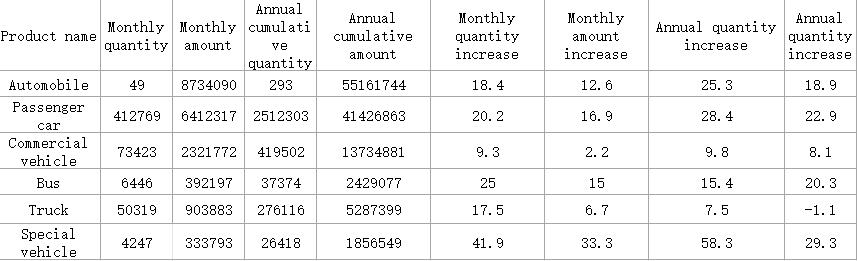

In June 2024, China exported 490,000 cars, an increase of 18% year-on-year from June 2023 and a decrease of 14% from the previous month. The year-on-year and month-on-month trends are very good; from January to June, China exported 2.93 million cars, with an export growth rate of 25%. The growth rate in the first quarter slowed down compared with the super-high growth rate in the previous three years. The growth rate rebounded from April to May, and fell sharply in June. The main driving force this year is still the improvement of the competitiveness of Chinese products, the slight growth of the European and American markets, and the comprehensive replacement of international brands in the Russian market by Chinese cars under the Russian-Ukrainian crisis, especially the increase in exports brought about by the improvement of China's fuel vehicle export competitiveness. From January to June 2024, China's automobile exports reached 55.2 billion US dollars, with an export growth rate of 18.9%. From January to June 2024, the average export price of automobiles was 19,000 US dollars, which was still basically the same as 19,000 US dollars in 2023.

The top five countries with the largest volume of Chinese automobile exports in June 2024: Russia 103,650, Mexico 34,408, UAE 26,451, Saudi Arabia 25,331, Belgium 14,760; the top five countries with the largest volume of Chinese automobile exports in June: Russia 20,589, UAE 13,934, the United States 8,922, Saudi Arabia 7,745, Israel 7,440.

The top five countries with the largest volume of complete vehicle exports from January to June 2024: Russia 478,480, Mexico 226,421, Brazil 171,068, UAE 141,950, Belgium 138,883; the top five countries with the largest volume of Chinese automobile exports from January to June: Brazil 141,987, Russia 107,933, UAE 69,383, Mexico 35,901, Kyrgyzstan 32,366. The incremental contribution of the top five countries is 66%, with Brazil making a huge contribution. From January to June 2024, markets such as Australia, Spain, Thailand, and Ecuador declined significantly; the Central Asian and Russian markets performed relatively strongly, and even the Russian market became a core market for growth.

The top five countries in terms of China's total new energy vehicle exports in June 2024: Belgium 14,501 vehicles, India 8,796 vehicles, Mexico 8,584 vehicles, the United Kingdom 8,018 vehicles, and Thailand 7,079 vehicles; the top five countries in terms of China's new energy vehicle exports in June compared with June 2023: Mexico 7,555 vehicles, Indonesia 5,489 vehicles, Israel 5,344 vehicles, India 4,122 vehicles, and the United Arab Emirates 3,336 vehicles.

The top five countries with the total volume of new energy vehicle exports from January to June 2024 are: Brazil 133,185, Belgium 129,832, the United Kingdom 76,036, Thailand 62,043, and the Philippines 51,549; the top five countries with the increase in China's automobile exports from January to June are: Brazil 116,607, Mexico 33,413, the United Arab Emirates 21,510, South Korea 18,187, and Indonesia 17,979. The contribution of the top five countries to the increase is 102%, among which Brazil's export contribution is huge.

The driving force for export growth is help from heaven, high quality, human efforts, and geopolitical changes. First, help from heaven - China's automobile industry chain is resilient; second, high quality - the export contribution of new energy has increased; third, human efforts - independent brand companies are very hard-working; fourth, geopolitical changes - the differentiated development of China's exports.